Banks are vital institutions in modern economies, as they provide the infrastructure and services necessary for the functioning of financial markets. They also play a crucial role in the payment system, facilitating the flow of payments and enabling economic activity. Banking institutions record millions of transactions every single day. Since the volume generated is enormous, its collection and registration are an overwhelming task for employees. Structuring and recording such a huge amount of data without any error becomes impossible without AI in banking.

In such scenarios, AI-based solutions in banking can help in efficient data collection and analysis. This, in turn, improves the overall user experience. The information can also be used for detecting fraud or making credit decisions. Eligibility for applying for a personal loan or credit gets easily automated using AI, which means customers can avoid the hassle of going through the entire process manually.

Artificial intelligence in the banking sector

The application of AI in banking helps through delegating repetitive tasks to automated systems, reducing reliance on human resources, and cutting operational costs. Duties such as customer service can now be performed by an AI banking assistant that can assist with payments, resolve tickets, and much more.

Why Is Artificial Intelligence (AI) Being Used in Banking?

AI in banking enables banks to manage huge volumes of data at record speed to derive valuable insights from it. Features such as AI bots, digital payment advisers and biometric fraud detection lead to higher quality of services to a wider customer base. All these AI-based solutions in banking translate to increased revenue, reduced costs and boost in profits.

Artificial intelligence in banking also plays a big role in managing risk. By leveraging AI, banks can detect fraudulent activities, cybersecurity threats, and market fluctuations in real-time, minimizing potential losses. Through automated assessments of potential borrowers, an AI-enabled system can create profiles for people and classify them into a degree of risk depending on pre-defined parameters.

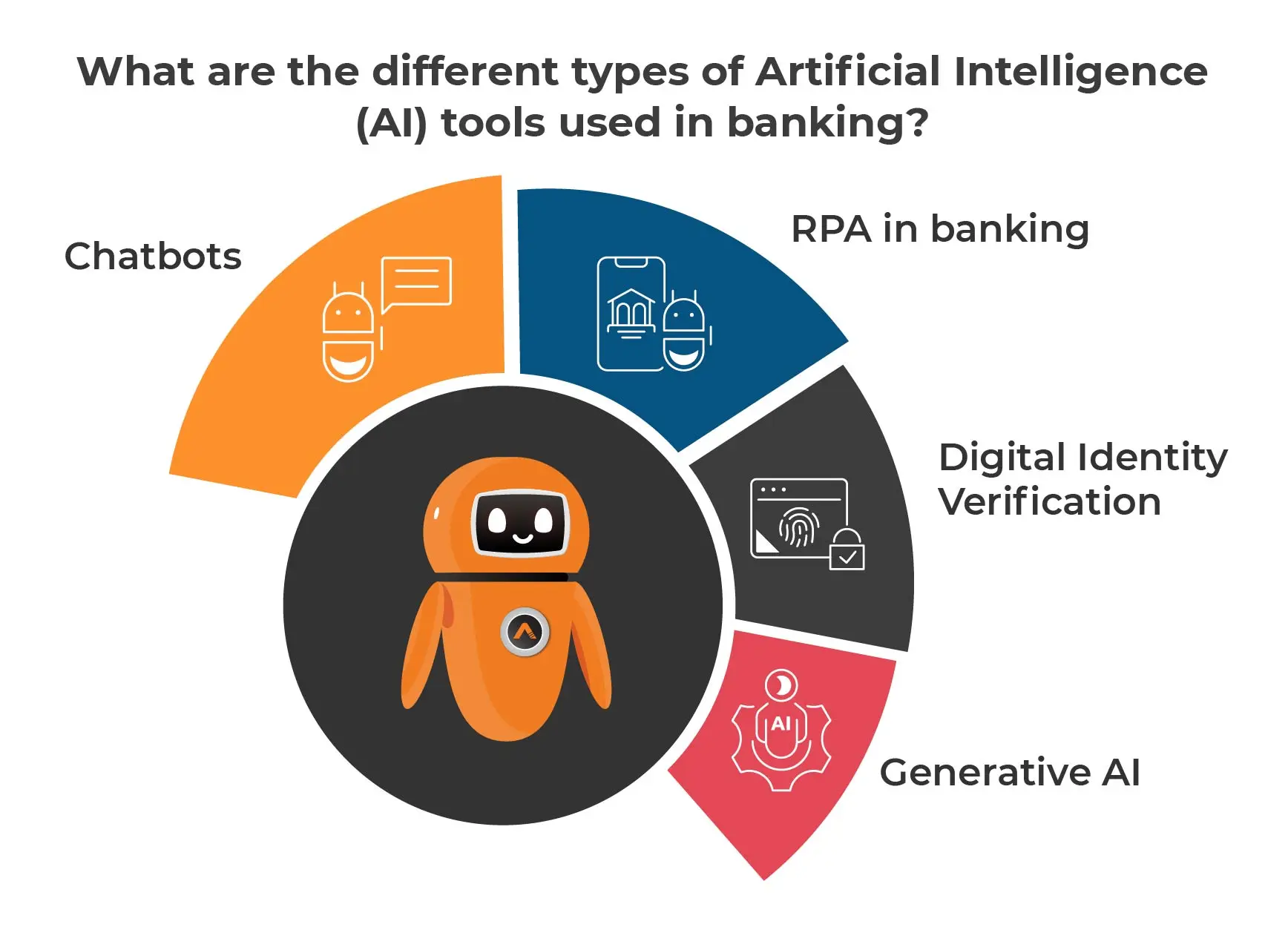

What are the different types of Artificial Intelligence (AI) tools used in banking?

Banks are expanding their use of AI technologies to improve customer experiences and their back office processes. Multiple AI based solutions in banking are being innovated to enhance the business operations and improve the customer experience. Some of these includes:

-

Chatbots

AI-powered chatbots and voice assistants are proactively used in banks to handle customers’ queries timely 24/7. It has made conversational banking more convenient and automated. Be it chatbots or voice bots, AI-powered solutions can conduct smart and compelling conversations on behalf of the bank with millions of consumers, at a fraction of the cost of using human customer service staff. The interactive nature of Conversational AI, and its speed and efficiency go a long way towards enhancing the customer experience.

-

RPA in banking

In the digital era, banks are dealing with a huge volume of data every day and manual/human handling of such voluminous data is not a good idea. Through robotic process automation, banks are effectively managing their business operations reducing human efforts, errors and operation costs. In addition, the implementation of RPA in banking reduces the process turnout from weeks and months to minutes.

-

Digital Identity Verification

AI-powered digital identity verification is used by many banks for the secure onboarding of clients. Manual identity verification is quite costly, time-consuming and prone to error. With digital id verification, banks are streamlining their KYC processes enhancing the customer experience. Moreover, these tools are very effective in fraud prevention.

-

Generative AI

Gen AI, an AI-based solutions in banking can process vast customer data, including transaction histories, spending patterns, and financial behaviors, to generate comprehensive insights. This enables more accurate and personalized recommendations based on individual financial profiles.

Revolutionizing Various Sector in Banking

-

Retail Banking:

AI-driven personalized recommendations not only enhance customer satisfaction but also increase cross-selling opportunities in banks. The streamlined transaction processes ensure faster and more convenient banking experiences, improving customer retention rates. With AI in banking, retail banks can leverage customer data to offer tailored financial products and services, fostering long-term relationships. AI algorithms also analyze transaction patterns in real-time to detect and prevent fraudulent activities, ensuring the security of retail banking operations.

-

Corporate Banking:

AI-powered risk assessment tools enable corporate banks to identify potential risks more accurately and efficiently, leading to better decision-making in corporate finance. Automated data analysis streamlines processes such as credit scoring and financial statement analysis, reducing the time and resources required for due diligence. By leveraging AI in banking, corporate banks can gain deeper insights into market trends and customer behavior, enabling them to offer more competitive financial solutions.

-

Investment Banking:

AI-driven algorithms optimize trading strategies by analyzing vast amounts of market data in real-time, helping investment banks capitalize on emerging opportunities. With AI-based solutions in banking, investment banks can make data-driven investment decisions, reducing the reliance on subjective judgments and increasing portfolio performance. By leveraging AI, investment banks can gain a competitive edge in a rapidly evolving market landscape.

-

Commercial Banking:

AI-based credit risk analysis tools accelerate the loan approval process by automating credit scoring and assessing the creditworthiness of borrowers more accurately. Enhanced financial services for businesses, facilitated by AI in banking, lead to increased operational efficiency and improved customer satisfaction. By leveraging artificial intelligence in banking, commercial banks can offer tailored financial solutions that meet the unique needs of businesses, driving growth and profitability.

-

Wealth Management:

AI-driven portfolio management tools provide high-net-worth individuals with personalized investment advice based on their financial goals and risk tolerance. By leveraging AI, wealth managers can optimize portfolio allocations, maximizing returns while minimizing risks. AI-powered wealth management platforms offer sophisticated investment strategies previously accessible only to institutional investors, empowering private banking clients to achieve their financial objectives.

-

Asset Management:

AI-powered analytics tools analyze vast datasets to identify investment opportunities and market trends, enabling asset managers to make informed investment decisions. With AI based solutions in banking, asset managers can optimize portfolio performance and minimize risks, enhancing returns for investors. AI-driven predictive models provide valuable insights into market dynamics, allowing asset managers to adjust investment strategies accordingly.

-

Cash Management:

AI-based cash flow forecasting tools analyze historical data and market trends to predict future cash flows accurately, enabling treasury teams to optimize liquidity management strategies. By leveraging AI, departments can identify cash flow patterns and anticipate liquidity needs, reducing the risk of cash shortages or excess liquidity. AI-driven risk management solutions help treasury teams identify and mitigate financial risks, ensuring the stability of cash management operations.

-

Compliance:

AI-driven compliance solutions automate regulatory compliance checks, ensuring adherence to legal standards and minimizing the risk of non-compliance penalties. With AI in banking, compliance processes can be streamlined, manual errors can be reduced, and efficiency in regulatory reporting can be improved to a greater extent. AI-powered legal analytics tools enable banks to analyze legal documents, contracts, and agreements more effectively, enhancing legal risk management and decision-making.

How AutomationEdge Help in Better AI Deployment?

AutomationEdge offers a low code solutions platform for banks with BankFlo. A ready-to-use solution that enables banks to automate repetitive tasks and help to streamline financial operations. a set of comprehensive automation solutions specifically designed for the bank. With DocEdge for intelligent document processing, CogniBot for Conversational Al and RPA for automation of repetitive processes banks can easily enhance their customer experience.

Whether it is adhar masking API or any UPI reconciliation or ID verification, BankFlo solutions addresses all banking challenges as per your need. It leverages advanced technologies like AI, RPA and OCR to streamline workflows, improve efficiency, and deliver significant ROI. To improve productivity in banking, be it for credit approval, loan underwriting, pitchbook creation, marketing and lead generation, customer service and debt collection, AI based solutions like Gen AI help banking infrastructure to resolve issues, streamline operations, and accelerate decision making.

Future Of Artificial Intelligence in The Banking Industry

These advances from AI in banking can provide automated reporting, improved risk transparency, higher efficiency in risk-related decision making, and partial automation in drafting and updating policies, etc. It will act as a reliable and efficient source of technology, enabling risk managers to make informed decisions swiftly and accurately. With AI-based solutions like RPA, Gen AI, Intelligent Document Processing, Conversation AI and the list goes on and on, banks can enhance their customer experience as these are designed to be easy to implement and use.