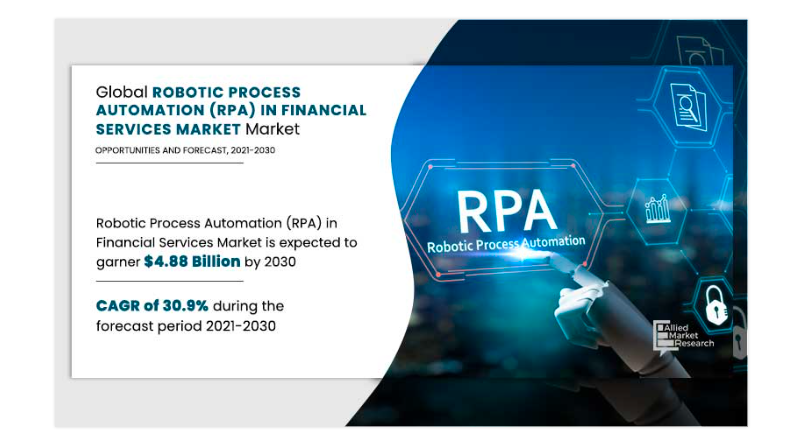

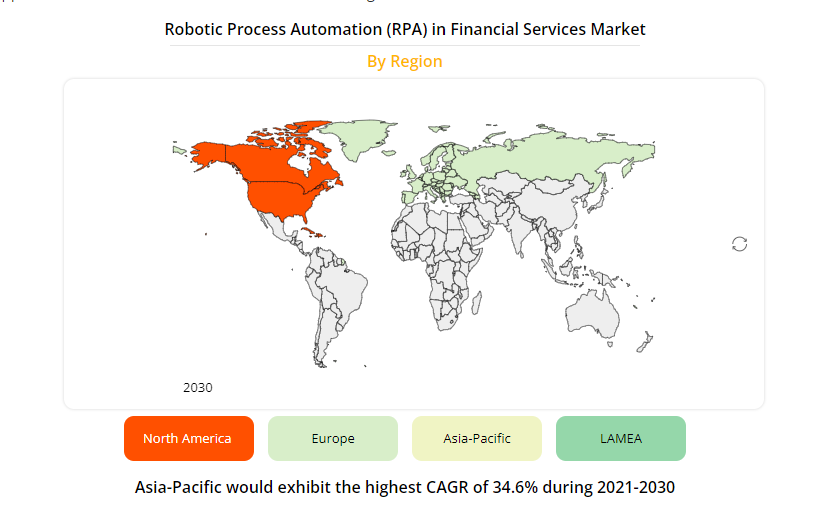

The increasing strides of emerging technologies have opened up new arenas and exciting possibilities for Banking, Financial Services, and Insurance (Banking) players. With the widespread adoption of automation in the industry empowering banking and financial services to deliver the best possible user experience to their customers. Robotic Process Automation, being of the leading technologies, has been exploring new horizons for the industry players by maximizing efficiency and keeping costs as low as possible and maintaining maximum security levels. Moreover, RPA in banking also addresses the never-ending challenge of scarcity of the skilled resource. According to reports, RPA in banking is expected to reach $1.12 billion by 2025.

What is Robotic Process Automation (RPA) in Banking?

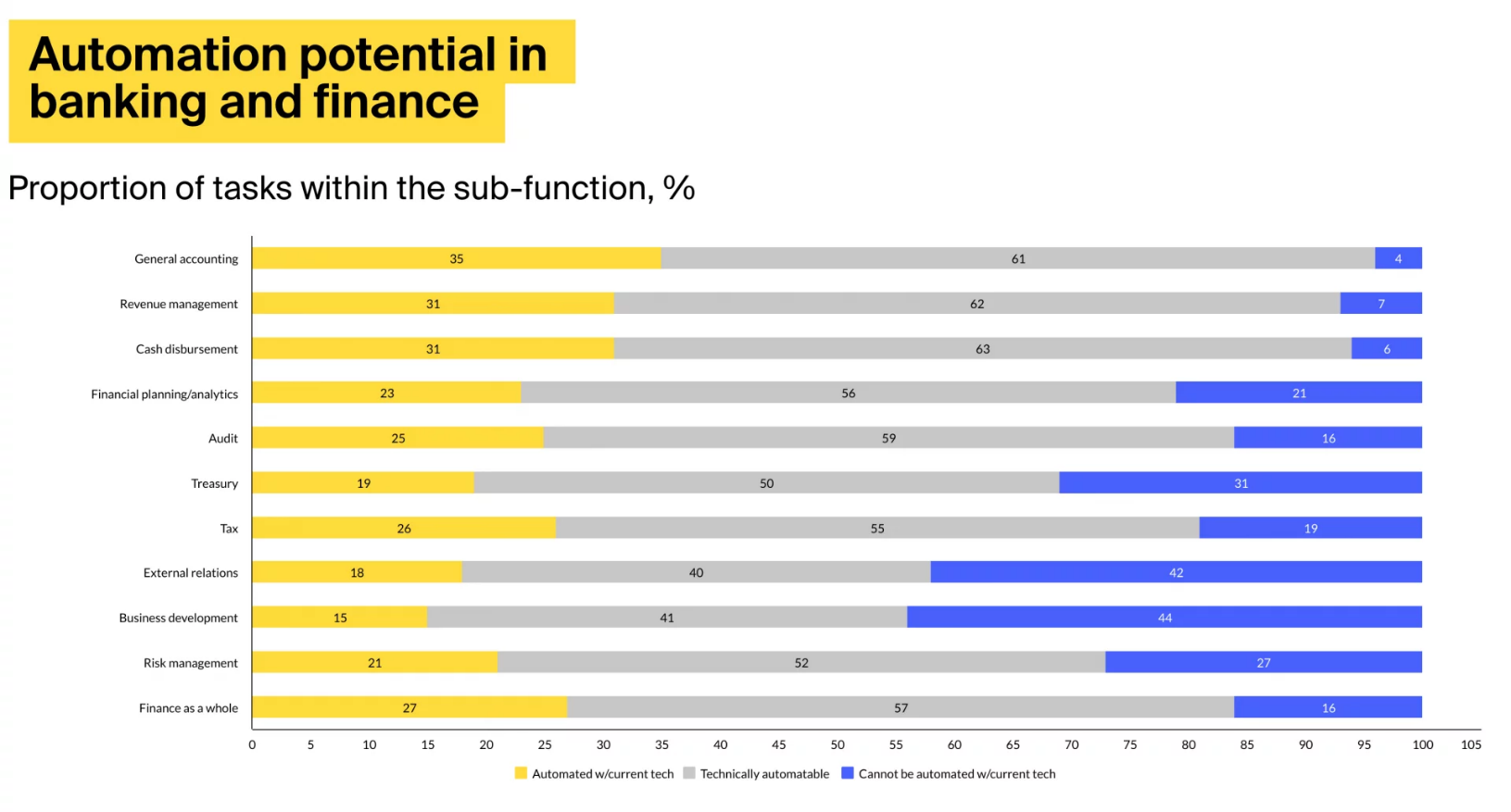

It has been strongly observed that banking and financial institutions are spending 10% of their operational costs on compliance. An estimate states that banks spend nearly $270 billion yearly on their compliance operations, and they are reported to spend over $321 billion on compliance operations, including fines.

Here, RPA can create magic for these players by not only automating mundane, repetitive and rule-based tasks but also maintaining high compliance norms. The primary aim of RPA is to enhance productivity by engaging customers in real time and leveraging the immense benefits of robots. This also helps in achieving robust governance.

The best part of implementing RPA in banking and financial services is that it doesn’t need any additional infrastructure. With ready workflows or integrations and a low-code, no-code approach, banks can easily hop on to RPA adoption and make the most of it. These RPA-based banking robots need structured inputs and governance. It also requires proper employee training.

Challenges of RPA in Banking Industry

- Resistance to Adopting Automation

ACCA and CAANZ research states 45% of respondents recorded that resistance to automation adoption is stopping them from implementing RPA. Despite technology’s maturity, resistance to its adoption has been a challenge. - Organizational Misalignment

This is the biggest challenge that any Banking player is afraid of. The idea of IT and business processes taking an automation leap that can cause a shift in roles and responsibilities can hugely impact organizational alignment. Many times, Banking organizations do not have a plan for process standardization and organizational alignment, and as a result of which, things go wrong at the initial stage only. - Investment in Legacy Infrastructure Replacement

Although the Banking sector is one of the most data-driven ones, it is lagging in the digital transformation curve. An outdated tech stack is to blame here. The banking platforms that operate the core system are old and do. Almost 43% of banks in the US use COBOL, a programming language developed in the 1950s. Replacement of such legacy systems is a massive task that needs huge investment. - Legal Requirements and Constraints

Banking organizations are bound to follow some legal regulations and constraints for process automation. RPA being a relatively young technology, does not follow the legal regulations issued by the government, central banks, and other parties. The regulatory complexity is being gradually erased by digital tools and technologies.

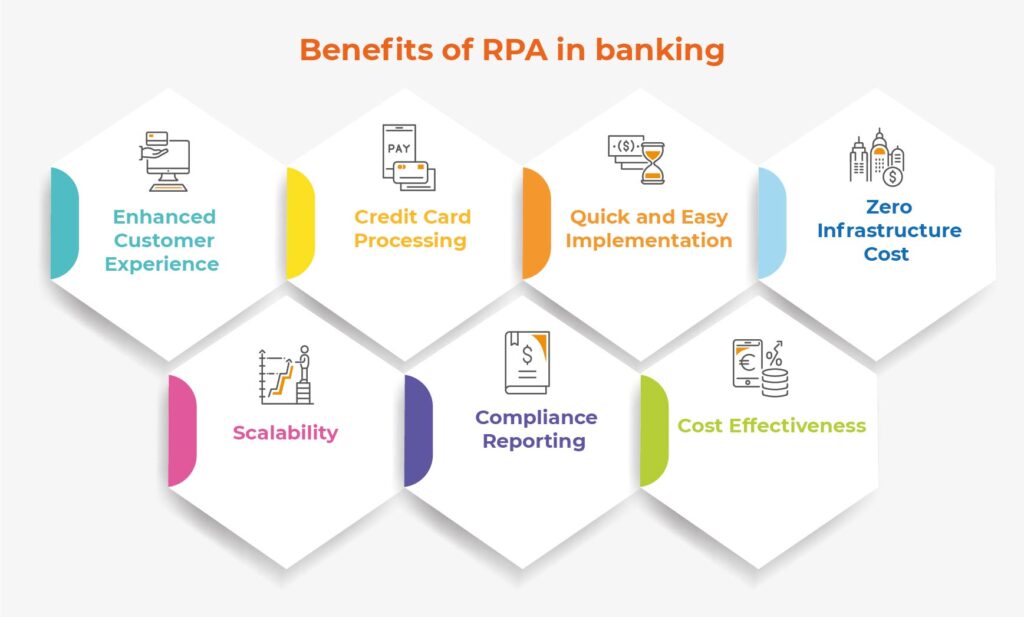

Benefits of RPA in banking

According to Gartner, 80% of leaders in the financial sector are already using some form of RPA for various banking and financial purposes. As we all know, RPA saves time, cost and effort; it also bridges the gap in skilled resource requirements. Here are some significant benefits of RPA in banking that are building futuristic banking and financial powerhouses.

- Enhanced Customer Experience

RPA allows banking players to deploy bots that address customer concerns and address them with customized solutions with a low turnaround time. It also helps to perform various other processes like online transactions, customer onboarding, managing each customer separately based on their needs, etc. Bots make baking services available 24X7 for its customers through mobile applications. - Credit Card Processing

Validating consumers and authorizing credit cards is one of the mundane and time-consuming processes that take days. RPA bots can expedite this process by approving or disapproving this authorization based on the defined workflows. - Quick and Easy Implementation

The drag-and-drop RPA technology helps to automate various banking processes. It makes automation workflow implementation easy as it doesn’t need any coding. - Zero Infrastructure Cost

RPA implementation neither needs any additional infrastructure nor asks for changes in the current automation setup. - Scalability

As per McKinsey, end-to-end digitized transactions enhance the scalability by 80%. RPA bots free up full-time employees by taking over their operations and managing high volumes of tasks during peak business hours. It allows banks to focus on more productive and significant operations. The insights collected by bots by processing voluminous financial data from various internal and external sources help financial institutions to understand customer behavior and design various personalization strategies with predictions. - Compliance Reporting

Automation helps banking organizations to generate the entire audit trails for every operation or function. It dramatically reduces risk and maintains high process compliance. - Cost Effectiveness

Similar to any other industry, automation garners significant cost savings for the Banking sector. Financial organizations can look at 40-60% savings in processing time and cost.

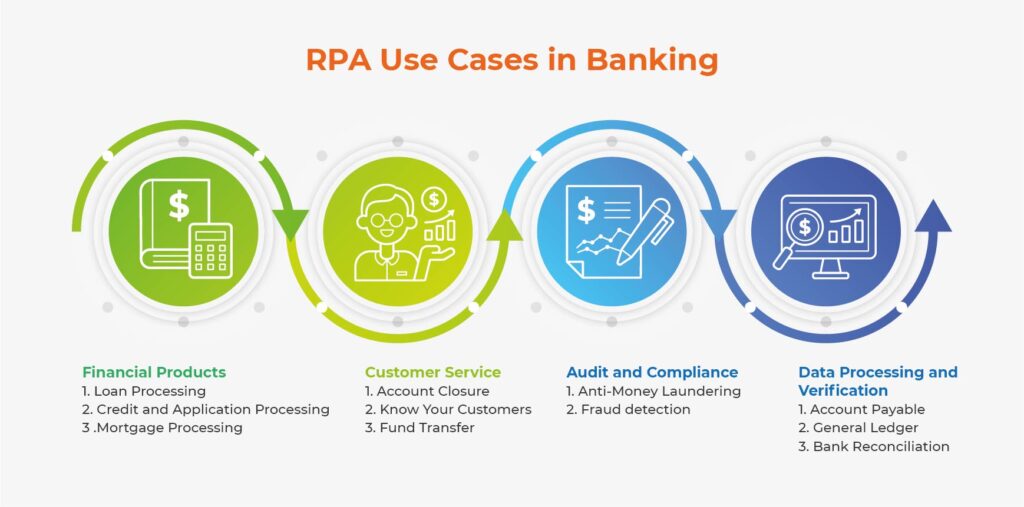

RPA in Banking Use Cases

Banking and financial organizations can use AI capabilities to make RPA automate the complex processes that require decision-making. This further enables employees with smart AI agent assistance while resolving customer queries and enabling smart conversations with instant resolution. Let’s go through top RPA use cases in banking and financial services.

- Financial Products

- Loan Processing: In banking, loan processing is one of the most tediously slow processes across the banking industry. RPA can bring down months-long processes to a record time of 10-15 minutes. Automation allows extracting relevant information from the documents submitted by the customer to verify all details.

- Credit and Application Processing: It takes only a few hours for the RPA software to gather all customer documents, make credit checks with detailed background verifications, and make wise decisions based on pre-defined parameters to check customer eligibility.

- Mortgage Processing: RPA Bots go through a defined set of rules to eliminate all potential bottlenecks to perform employment verification, credit checks, and inspection before approving each loan request.

- Customer Service

- Account Closure: RPA enables banks to tackle this issue by seamlessly tracking all accounts and sending those continuous automated notifications and additional reminders for timely submissions.

- Know Your Customers: Banks have now started leveraging RPA to collect customer information, screen it, and perfectly validate it to reduce the considerable cost and resources.

- Fund Transfer: RPA automates the transfer of funds for the account whereby transfers between a customer’s two (or more) accounts are made on a regular, periodic basis under specified conditions.

- Audit and Compliance

- Anti-Money Laundering: RPA proactively catches suspicious fund transactions and prevents them from occurring.

- Fraud detection: With the advent of robust RPA technology, banking frauds have only multiplied. Thus, it is next to impossible for banks to check every transaction to identify fraud patterns manually in real time.

- Data Processing and Verification

- Account Payable: RPA empowers businesses to automatically credit all payments to the vendor’s account after detailed validations and reconciliation of errors.

- General Ledger: RPA integrates data from diverse legacy systems to collaboratively present them in the required format. This reduces the amount of data handling efforts and time.

- Bank Reconciliation:RPA solutions would allow banks to build applications for reconciliations that offer automated journal entries, sophisticated data comparison, and long-term archiving.

How to Implement RPA in Banking Industry?

Implementing RPA in the banking industry requires a thorough understanding by keeping all things in consideration. There are specific vital considerations to keep in mind while implementing RPA in the banking industry, and these are-

Identify Perfect Fit Process first, and check the repetitive process that requires a lot of manual intervention. Also, start with simple and basic processes that can be automated with a predefined workflow. Once that is done, look for the complex business process that requires decision-making.

- Assess the process feasibility, and evaluate the complexity of the process, availability of data and systems, and potential benefits of automation.

- Choose the right RPA vendor as per the business requirements and check the reliability, scalability, and security of the RPA tool, as well as its ability to integrate with banking applications.

- Check the automation scripts after finalizing the RPA tool. It is important to ensure that the RPA tool is working efficiently and that there are no errors.

- Deploy the automation script in the production environment, monitor, optimize, and continuously monitor the RPA tool for better performance.

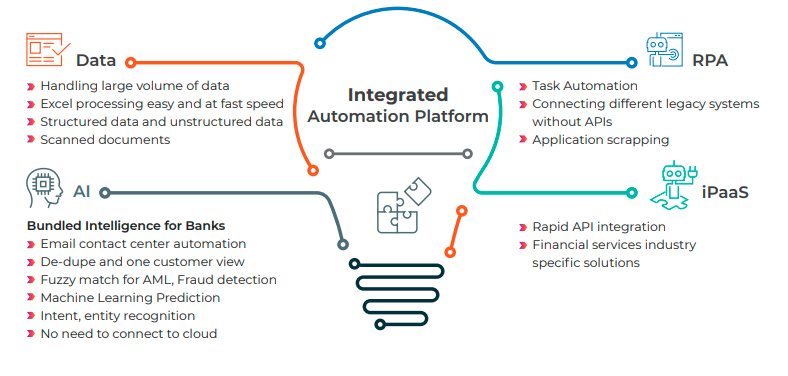

How does AutomationEdge RPA Help Banking and Financial Services?

AutomationEdge is leading RPA solution providers to streamline business processes and relieve resources from mundane and repetitive tasks like data validation, comparison, system update, and so on. With its hyperautomation approach, AutomationEdge uses a combination of technologies like Conversational AI and Automation, Intelligent Document Processing, and AI agent assistance, providing operational efficiency and reducing costs with increased compliance. Also, AutomationEdge has a ready solution workflow (SolFlo) for your banking process that makes them more efficient and scalable. These ready solution workflows are-

Frequently Asked Questions (FAQs)

- Why is RPA important in Banking?

RPA in banking and financial services has seen a significant rise in the past few years due to the changing market demand and customer experience. Besides ruling out the manual intervention requirements, RPA enhances employee productivity and reduces operational costs. RPA is another reason for high RPA adoption in banking and financial services. If we look at the reports in the future, the RPA market growth is about to grow by 38.2% from 2022-2030. - What are RPA Examples in Banking Industry?

RPA in the banking industry can be used in multiple time-consuming and repetitive processes like account opening, closure, claims process, KYC check and many others. By starting small, RPA can also be utilized in other banking processes like fraud detection, antimony laundering and decision-making. - What is the Cost of RPA Implementation?

The cost of RPA implementation in the banking industry entirely depends on the business requirements and RPA vendors the organizations are choosing. As per the requirement, banking organizations can choose an RPA vendor who offers RPA as a service and also provide subscription and consumption-based pricing. This eases the RPA implementation for banking organizations and enables them to scale up and down as needed.